How Carbon Footprint Management Drives Corporate Financial Performance

Why Managing Carbon Emissions Isn’t Just About the Planet—It’s About Your Profits

For manufacturers, the days of treating carbon management as a feel-good initiative are over. What was once CSR has become a boardroom priority—and not just because of compliance pressure. It’s now one of the smartest financial decisions a company can make. As pressure from regulators, investors, and supply chain partners grows, carbon footprint management is proving to be a key lever for improving financial performance.

Below are six ways it directly supports the bottom line:

1. Regulatory Compliance Avoids Costly Disruption

Governments around the world are introducing stricter carbon reporting and reduction requirements. From the EU’s Carbon Border Adjustment Mechanism (CBAM) to India’s BSRS and the U.S. SEC’s proposed disclosure rules, the cost of non-compliance is rising.

Companies that act early are less likely to face penalties, border tariffs, or lost access to key markets. Staying ahead of these regulations not only protects revenue—it avoids sudden compliance costs and last-minute operational overhauls.

2. Lower Emissions Often Mean Lower Costs

Reducing carbon often goes hand in hand with improving efficiency. High-emission operations usually involve high energy use, excess waste, or inefficient logistics. By measuring and managing emissions, manufacturers can spot where resources are being wasted.

For example, energy audits can uncover savings on electricity and fuel, while process improvements can reduce scrap and downtime. Carbon reduction isn’t just good for the planet—it often delivers direct cost savings.

3. Investors Are Watching Carbon Performance Closely

Environmental, Social, and Governance (ESG) factors now influence capital flows. More investors and lenders expect companies to disclose their carbon data and demonstrate credible reduction plans.

Strong carbon management can improve access to green financing, reduce borrowing costs, and enhance company valuation. Many firms have already benefited from sustainability-linked loans or higher ESG scores that improve investor confidence. In short, carbon performance is emerging as a key financial metric.

4. Supply Chain Expectations Are Changing

Manufacturers that supply major OEMs or global brands are under growing pressure to share emissions data and meet sustainability criteria. Carbon footprint management is no longer optional—it’s part of doing business with key customers.

Companies that can’t provide timely, accurate carbon data risk losing preferred supplier status or being cut from sourcing lists. On the other hand, proactive suppliers often gain preferred status and secure longer-term contracts.

5. Sustainability Builds Brand Trust

While the financial benefits of carbon reduction are clear, reputational value should not be underestimated. Companies that lead on sustainability don’t just earn trust—they build emotional loyalty that competitors can’t easily replicate.

Even in B2B industries, ESG credentials increasingly factor into buying decisions. Public reporting and third-party ratings (such as CDP scores) help signal leadership, accountability, and long-term thinking.

6. Future-Proofing Through Innovation

Taking carbon seriously drives innovation. Whether it’s switching to renewable energy, adopting digital tracking tools, or rethinking materials and processes, companies that invest early in low-carbon solutions often gain a competitive edge.

Those who wait may find themselves reacting to rising carbon prices or mandatory emissions cuts. Those who lead can shape the rules and unlock new market opportunities.

Conclusion

In the coming decade, carbon performance may matter just as much as EBITDA. If you think decarbonization is costly, consider the cost of being left behind. In this race, the early movers are already setting the pace. From reducing operating costs to unlocking capital, retaining customers, and building brand value, the benefits are tangible.

For manufacturing leaders, the message is clear: managing carbon is managing risk, cost, and growth. The companies that act now will be best positioned to succeed in the low-carbon economy that’s already taking shape.

Explore more

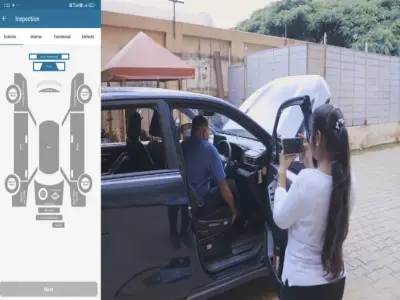

The Basics of Vehicle Digital Inspection: What It Is and How It Works

Discover how digital transformation is revolutionizing vehicle inspection processes, improving efficiency, accuracy, and compliance while reducing costs and environmental impact.

India's Logistics Challenges: Understanding the Roadblocks and the Way Forward

Explore how predictive maintenance technologies are transforming equipment management, reducing downtime, and optimizing operational efficiency in modern manufacturing.