Regulatory Landscape Update: BRSR, CBAM, and Other Compliance Drivers

Why Global Carbon Regulations Are Reshaping The Manufacturing Landscape

In the global drive toward net zero, carbon management has evolved from a voluntary sustainability initiative into a compliance backbone for manufacturing industries. New reporting standards, carbon pricing schemes, and cross-border mechanisms are redefining the rules of trade and investment.

For business leaders, regulatory readiness is increasingly synonymous with business readiness. Understanding the frameworks shaping carbon disclosure — from India’s Business Responsibility and Sustainability Reporting (BRSR) to the EU’s Carbon Border Adjustment Mechanism (CBAM) — is essential to securing market access, capital, and credibility.

India’s BRSR: Building a Foundation for Transparent Sustainability Reporting

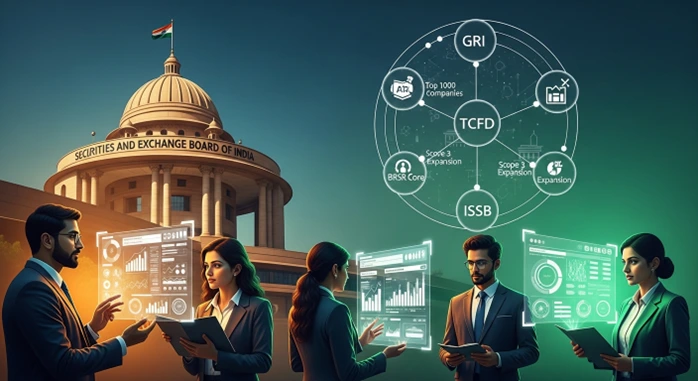

India’s Business Responsibility and Sustainability Reporting (BRSR) framework, introduced by Securities and Exchange Board of India (SEBI), is setting a new benchmark for corporate transparency.

- Mandatory for top-listed companies: W& FY 2022-23, the top 1,000 Listed entities are mandated to publish BRSR reports detailing ESG performance and climate-related actions.

- BRSR Core evolution: SEBI has introduced the BRSR Core framework to enhance comparability and reliability of ESG disclosures. Industry observers expect future iterations to expand coverage to Scope 3 emissions and supplier-level data.

- Global alignment: BRSR Core embeds metrics inspired by Global Reporting Initiatives (GRI), Task Force on Climate-related Financial Disclosures (TCFD), and International Sustainability Standards Board (ISSB), ensuring partial interoperability with international disclosure systems.

This shift will push manufacturers to map and measure emissions across their value chains rather than focusing solely on factory-level energy use. Those building supplier data collection systems early will gain a clear compliance and reputational advantage.

EU’s CBAM: Redefining Market Access Through Carbon Pricing

The European Union’s Carbon Border Adjustment Mechanism (CBAM), rolled out in October 2023, represents a major structural change in global trade. It places a carbon price on imported goods — such as steel, aluminum, cement, fertilizers, hydrogen, and electricity — aligning them with EU domestic carbon costs under the Emissions Trading System (ETS).

Key implications for manufacturers include:

- Mandatory emissions disclosure: During the transitional phase (2023–2025), exporters must provide verified product-level data on Scope 1 and 2 emissions to EU importers.

- Carbon cost exposure: From 2026 onward, EU importers will purchase CBAM certificates reflecting the embedded carbon cost of imports.

- Data credibility as a trade condition: Companies unable to provide transparent data risk facing border delays, administrative penalties, or even loss of EU market access.

CBAM effectively links carbon efficiency to global competitiveness — turning credible emissions data into a trade credential as vital as price or quality.

Other Emerging Compliance Drivers: ASEAN, U.S., and Japan

Beyond India and the EU, other economies are advancing their own carbon reporting and pricing frameworks:

- ASEAN’s proposed Common Carbon Framework (ACCF): Currently under discussion, this initiative aims to harmonize regional carbon reporting and enable future cross-border credit trading.

- U.S. SEC Climate Disclosure Rules: The final rule adopted in early 2024 (currently subject to legal challenges) requires listed companies to disclose Scope 1 and 2 emissions, with Scope 3 disclosures applicable only if material or already tracked. The rule remains under judicial review.

- Japan’s GX League and Carbon Pricing Initiatives: Japan’s government-led GX League and the trial Green Transformation ETS launched in 2023 are incentivizing corporate decarbonization and promoting transparency.

Collectively, these frameworks signal a global convergence toward transparent, auditable carbon data — a trend accelerating as regulators and investors align expectations.

How These Regulations Impact Manufacturers

The tightening global regulatory web brings both challenge and opportunity:

- Data Burden and Complexity: Manufacturers must now capture and verify emission data across all scopes, requiring digital infrastructure and supplier engagement.

- Financial and Operational Risk: Carbon pricing and disclosure-linked trade conditions may impact costs, margins, and market access.

- Strategic Advantage for Early Movers: Companies that integrate carbon management proactively can reduce future compliance costs, strengthen ESG ratings, and attract green financing.

In this dynamic environment, compliance should be seen not as a bureaucratic duty but as a strategic capability.

Policy-Readiness Roadmap for Manufacturers

To stay ahead of policy evolution, manufacturing leaders should prioritize building organizational and data infrastructure aligned with emerging regulations:

- Establish a Carbon Governance System - Form cross-functional teams responsible for GHG tracking, reporting, and assurance aligned with the GHG Protocol and ISO 14067.

- Embed Supplier Collaboration Mechanisms - Create guidelines, training programs, and contractual clauses to facilitate upstream emission data sharing.

- Leverage Digital ESG Platforms - Deploy integrated platforms connecting ERP and supply chain systems to automate data collection and generate regulatory-ready reports.

- Conduct Policy Scenario Planning - Assess exposure to frameworks such as CBAM, BRSR, SEC, and GX, and model for potential future compliance costs.

- Align with Global Disclosure Standards - Use ISSB, GRI, and TCFD frameworks to ensure interoperability and minimize duplication across jurisdictions.

Conclusion

The age of fragmented sustainability reporting is ending. As frameworks like BRSR, CBAM, and others mature, a convergence toward globally harmonized carbon accountability standards is fast emerging. Manufacturers that institutionalize governance, digitalize data processes, and anticipate regulatory shifts will not only achieve compliance but gain strategic influence in shaping the next generation of sustainable trade. In the low-carbon economy, regulatory alignment is the new benchmark of leadership.

Explore more

Why Carbon Footprint Management is Becoming a Business Imperative

Manufacturers are at the forefront of the global effort to reduce carbon emissions. What was once a voluntary sustainability initiative has evolved into a non-negotiable business requirement. Today, managing carbon emissions is not optional—it is a strategic necessity that directly influences market access, brand equity, and long-term business resilience.

The Basics of Vehicle Digital Inspection: What It Is and How It Works

Discover how digital transformation is revolutionizing vehicle inspection processes, improving efficiency, accuracy, and compliance while reducing costs and environmental impact.